Deep Dive: Trump’s Wage Garnishments Threaten to Obliterate the Middle Class

Of all the ways to harm working class Americans, this may be the most preventable and ill-advised.

In a stunning example of “kicking them while they’re down,” the Trump administration will begin garnishing wages from people with student loan debt. Given his other policies, such raising prices on everything with tariffs, and exposing millions of Americans to financial abuse by decimating the Consumer Financial Protection Bureau, it is hard to imagine any motive except to punish the middle and working class.

In the midst of this chaos, working class Americans got even more bad news: Donald Trump will authorize wage garnishments for people with student loan debt.

I cannot think of a worse policy decision at a worse time.

But how did it come to this, what does it mean for working class people, and how can we fight back?

The Student Debt Bubble

The student loan crisis didn’t happen overnight. It is the result of decades of bad policy, ballooning costs, and sluggish wage growth.

My father earned his degree in dentistry with about $16,000 in student loan debt. He worked while in school, which helped keep his debt low. But those were simpler times. My education, including law school, cost me about $174,000 in student loans. By the way, I worked throughout the entirety of my undergrad and law school education—tutoring, driving for Uber, and even working as a groundskeeper in the early mornings (ask me about my green thumb sometime). To further chip away at the costs, I also earned scholarships and grants.

By the time I was sworn in as a lawyer, I’d racked up a $174,000 tab despite my best efforts. For reference, my father bought his first home for about that much.

It is far too simple to say my dad “worked harder,” though he did work hard.

Rather, my experience was similar to what millions of Americans are experiencing. In fact, when we look at the average costs of college, I got off really easy.

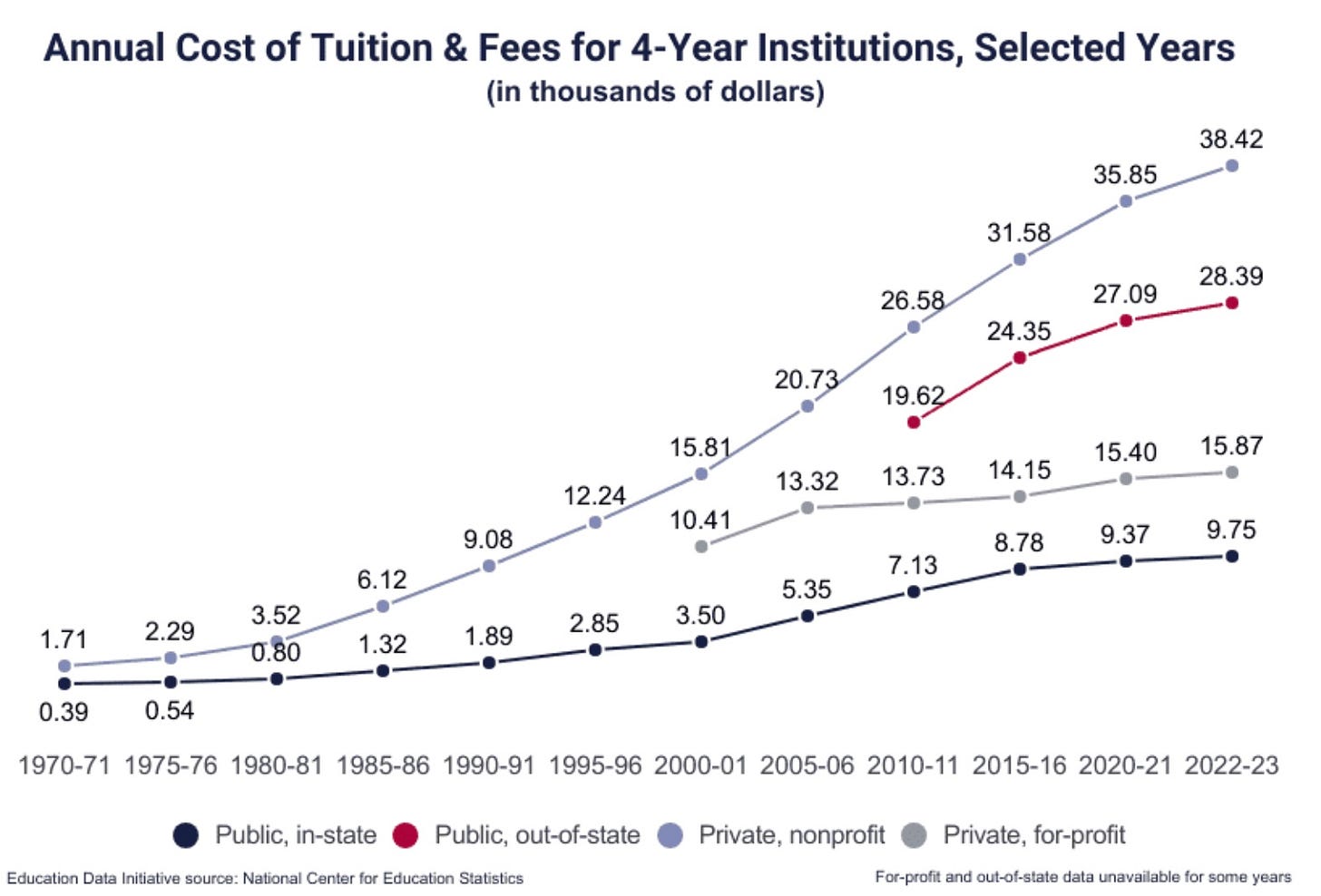

Costs are skyrocketing to unsustainable levels:[1]

· The average 4-year cost of attendance for a student living on campus at an in-state, public college is $108,584.

· Out-of-state students pay an average $182,832 over 4 years.

· Private, nonprofit university students pay an average of $234,512 over 4 years.

· Student borrowers pay an average of $2,636 in interest alone each year, and the average borrower spends roughly 20 years paying off their loans.

American students are graduating college and graduate schools with more debt than ever. And the debts have soared so high that just making the monthly payments is a struggle on its own. But other benchmarks of a middle-class lifestyle, such as home ownership, are being pushed further and further out of reach.

The result? First, getting an education is exponentially more expensive than it was just a few decades ago.

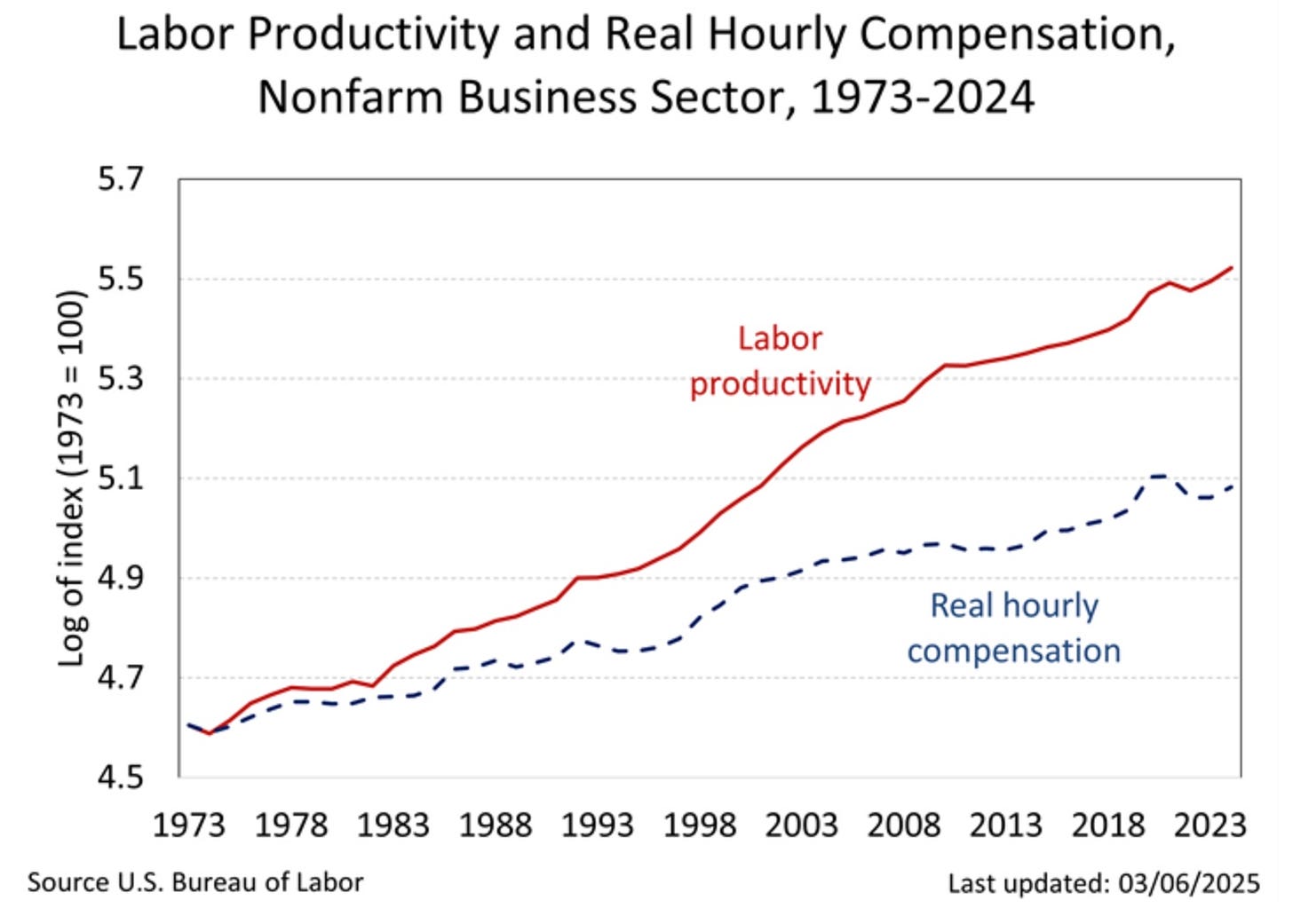

Meanwhile, real wages for college-educated Americans, once the keystone of the nation’s thriving middle class, are not keeping up. This leaves them more vulnerable to economic disruption than ever.[2]

The U.S. is unique among developed nations in that students are not offered low-cost or cost-free tuition, but rather, are required to take on enormous debt to finance their education. It’s a gamble—one that has historically paid off. But as the required loan debt continues to skyrocket, and as wages barely keep up, the odds appear stacked heavily against student loan borrowers.

Fuel to the Fire – The Pandemic

I’ll keep this short since most people reading this remember a certain… incident in early 2020. One that led to millions of American’s losing their jobs as the COVID-19 pandemic ripped through the country. That caused millions of American’s to lose the income the depended on to repay their loans, income which was already struggling to keep up. The result was a massive spike in student loans placed in forbearance, or worse, in default.

Who Pays for Student Loan Defaults?

This is extremely simplified, but in essence this is how federal student loans are funded:

The U.S. Department of Education is the lender. Once distributed to the student for things like tuition, housing, and food, the loan accumulates interest on the debt which the student must repay. The Department of Education then contracts private loan servicers (like Nelnet) to handle the billing and customer. These loan services can make substantial profits through these contracts.

Unlike other debts, such as credit cards, student loan debt is non-dischargeable. Meaning that even if you declare bankruptcy, the debt from your education follows you for life.

It’s a broken system that has had two unpleasant outcomes. First, the loan system has incentivized out of control cost increases for education. Since most students rely on U.S. Department of Education loans, the colleges are free from the typical “free market” pressures that would otherwise keep costs down.

Normally, that’s not such a terrible thing. The government can and should invest in education. But what happened over the past several decades was that colleges were incentivized to raise the cost of everything, from tuition to textbooks, because federal loans always paid the tab upfront.

Students Trapped in a Sisyphean Spiral

The college gets paid, the student gets an education, and hopefully they get a good job. But, and this is arguably the worse part, students who make their payments on time for years are often shocked to find that they have barely made a dent, or worse, actually owe MORE than the original debt!

How is that so?

Interest. Lots and lots of interest. The private loan servicers need to earn a profit, and since they are not the ones issuing the U.S. Department of Education loans, the interest is how they collect revenue. This means students can pay for years while the interest keeps them in debt.

Like the ancient Greek myth, students are like Sisyphus pushing the boulder of student loan debt uphill for life.

The Student Loan Crisis Hurts Everyone

“I shouldn’t have to pay for YOUR debt!”

I understand the sentiment. Yet this argument misses the point. America’s profit-driven approach to education is the problem, not the students who took a risk on acquiring a degree. America’s inability to provide workers with an affordable standard of living, in part caused by sluggish wage growth compared to productivity, is more at-fault than 18-year-old who enrolled in college with hopes of building a better life for themselves.

And all the poor policy decisions, the economic pressures, and the erratic decisions in Trump’s White House will come to a head in May.

TRUMP WAGE GARNISHMENT

Entering the proverbial house fire with a bucket full of gasoline, the Trump administration has a solution only a 34x convicted felon could concoct—garnish the wages of anyone who is behind on their student loan payments.

This plan is not only cruel, but also stunningly self-destructive.

Wage garnishments can take up to 15% of a borrower’s income. It can be confiscated from regular earnings, but also critical lifelines like social security.

That’s right—the cost of education has ballooned so much that we have retirees in this country who are still trying to pay off their loans.

Trump’s wage garnishment policy will affect a segment of borrowers who are already in financial distress—disproportionately affecting working-class individuals, those with low incomes, and people of color.

While borrowers default on student loans for a variety of reasons, the inability to afford the payments is the common thread, often compounded by lack of economic payoff from their education (compare the data of college costs vs. wage growth earlier in this article.)

For decades, we assured students that if they worked hard, got an education, and applied themselves, then the debt would be but a small price to pay for better long-term prospects.

But as college costs soared, and as years of on-time payments failed to even make a dent in the debt, the promise appears to be broken. The result? A working class weighed down by untenable financial burdens, resulting in less consumer spending, less demand for products and services, and depressed economic growth.

In short, the burden caused by student debt harms all of us, not just the students.

As Trump insists that the only way to grow the U.S. economy is to bring more manufacturing jobs home, his focus on supply-side economics misses the point—that there is simply no demand for such manufacturing when working class people are broke.

The ripple effects, should the garnishments proceed, will be catastrophic.

It will start with delinquencies on rent, car loans, and consumer debt like credit cards. Interest rates will skyrocket, sending both the stock and bond markets into an accelerated downward spiral. With no consumer demand, and no future growth prospects, the U.S. will become a massive liability for domestic and foreign investors. Advanced economic activity, such as work in the tech and professional services sector, will grind to a halt, triggering layoffs and mass unemployment.

To the Factories!

The irony is that such an economic meltdown would deliver Trump’s wish by making manufacturing in the U.S. cheaper, but it would do so at tremendous political, social, and economic cost. Americans who for generations have grown accustomed to the world’s “highest standard of living”—in part supported by high levels of education—will be forced to forego such education due to its unaffordability. They may opt instead to avoid debt by taking low-skilled, low-wage jobs.

In short, by demonizing education, by attacking academia as a whole, and by crushing Americans with tariffs and wage garnishments, Trump may usher in a second Gilded Age.

One where a few hundred people live like royalty, while the average American toils in the dark.

In the Darkness, a Light Twinkles

Fortunately, this grim future is not inevitable. Several organizations have pushed back. Notably, several advocacy groups and borrower rights organizations have condemned the policy. We can expect lawsuits challenging the wage garnishments any day now.

How can I prepare?

In the meantime, the best advice I have is for everyone with student loan debt to download their data. Make sure the numbers are accurate, and keep that information someplace safe. Save up what you can and avoid any non-essential consumer debt until we get more clarity on this policy.

Ultimately, the best way you can protect your money is to understand your rights at work. In addition to in-depth policy analysis like this, my Substack includes helpful tips to ensure you get every penny you are owed from your work.

If you are not a free subscriber yet, please consider joining our workers’ rights community.

[1] Source: Education Data Initiative

[2] Source: U.S. Bureau of Labor Statistics.

“Can’t think of any other reasons he’s doing this but to hurt the working class.” That’s all he knows how to do. There’s a place in H.E…double hockey sticks for him and his cronies. Following and subscribed, love what you do. Thank you!

Thank you Ryan. I'm watching this one very closely and really appreciate everything you do to help us understand what's happening.